Plaintiff United States Securities and Exchange Commission (“Commission”) alleges the following against Defendants Alliance Transcription Services,...Plaintiff United States Securities and Exchange Commission (“Commission”) alleges the following against Defendants Alliance Transcription Services, Inc. (“Alliance” or “Company”), Clifford A. Lewis (“Lewis”), Richard A. Dabney, Raymond C. Dabney, Philip M. Young (“Young”), Charles J. Smith (“Smith”), and William D. O’Neal (“O’Neal”):

SUMMARY

1. This matter concerns a scheme to manipulate the price and trading volume of Alliance stock through false and misleading public disclosures and to issue and sell Alliance stock in an unregistered distribution from at least April

vs.

Alliance Transcription Services, Inc.; Clifford A. Lewis; Richard A. Dabney; ) Raymond C. Dabney; ) Philip M. Young; Charles J. Smith; and ) William D. O’Neal, )

Case 2:08-cv-01464-NVW Document 1 Filed 08/08/2008 Page 1 of 17

1 2 3 4 5 6 7 8 9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2005 through at least September 2006. Alliance, a Nevada corporation, purported to provide unique expertise in the field of homeland security, and its common stock was quoted at all relevant times on the Pink OTC Markets quotation system formerly known as the Pink Sheets.

2. Defendants Alliance, Richard Dabney, and Lewis manipulated the market for Alliance’s stock by making false and misleading public disclosures in press releases issued by Alliance and published through business newswire services and on Alliance’s website.

3. Defendants Alliance, Richard Dabney, Raymond Dabney, Young, Smith, and O’Neal participated in the unregistered distribution of Alliance securities from July 2005 to September 2006 through a series of purported offerings by Alliance to a Texas company controlled by Smith. Raymond Dabney, Young, and Smith arranged for Alliance to issue stock to the Texas company in offerings that purportedly were exempt from registration and through which stock certificates purportedly could be issued without printed legends restricting the stock’s resale. In fact, the transactions between Alliance and Smith’s company were not exempt from registration and were merely a device to evade the registration provisions of the federal securities laws. Once issued to Smith’s company, the stock was immediately distributed to third parties without being paid for by Smith. Richard Dabney and O’Neal enabled Alliance to engage in those transactions by providing the necessary corporate resolutions and legal opinions, respectively.

4. Defendants Young, Smith, and O’Neal received Alliance stock through the unregistered distribution and sold it into the market without registration or a valid exemption from registration. Defendants Lewis, Richard Dabney, and Raymond Dabney received a portion of the proceeds that Young obtained by selling the Alliance stock.

5. By their conduct, Alliance, Lewis, and Richard Dabney violated

Case 2:08-cv-01464-NVW Document 1

Filed 08/08/2008 Page 2 of 17

2

1 2 3 4 5 6 7 8 9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 thereunder, and Alliance, Richard Dabney, Raymond Dabney, Young, Smith, and O’Neal violated Section 5 of the Securities Act of 1933 (“Securities Act”).

6. The Commission seeks relief including: permanent injunctions against all the Defendants; disgorgement of ill-gotten gains plus prejudgment interest thereon and civil monetary penalties against Lewis, Richard Dabney, Raymond Dabney, Young, Smith, and O’Neal; penny stock bars against Lewis, Richard Dabney, Raymond Dabney, Young, and Smith; officer-and-director bars against Lewis and Richard Dabney; and any other appropriate relief.

JURISDICTION

7. The Commission brings this action pursuant to Section 20(b) of the Securities Act [15 U.S.C. § 77t(b)] and Section 21(d) of the Exchange Act [15 U.S.C. § 78u(d)].

8. This Court has jurisdiction over this action pursuant to Sections 20(b) and 22(a) of the Securities Act [15 U.S.C. §§ 77t(b) and 77v(a)] and Sections 21(d), 21(e), and 27 of the Exchange Act [15 U.S.C. §§ 78u(d), 78u(e), and 78aa].

9. In connection with the acts, transactions, practices, and courses of business alleged in this Complaint, the defendants, directly or indirectly, made use of the means or instruments of transportation or communication in interstate commerce, the means or instrumentalities of interstate commerce, the mails, or the facilities of any national securities exchange.

THE DEFENDANTS

10. Alliance is a Nevada corporation that is based in Rancho Palos

Verdes, California, and was based in Harrison, Maine, at all relevant times. From December 2004 to August 2007, the Company, which was then known as Strategy X, Inc., purported to provide unique expertise in the field of homeland security.

Case 2:08-cv-01464-NVW Document 1

Filed 08/08/2008 Page 3 of 17

3

1 2 3 4 5 6 7 8 9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Alliance’s common stock was quoted on the Pink Sheets at all relevant times, but it has not traded actively since October 4, 2007, when the Commission ordered a 10-day trading suspension pursuant to Section 12(k) of the Exchange Act [15 U.S.C. § 78l(k)]. At all times relevant to this Complaint, Alliance’s common stock has been a penny stock because the Company’s net tangible assets and average revenues have been below the thresholds established under Section 3(a)(51) of the Exchange Act [15 U.S.C. § 78c(a)(51)] and Rule 3a51-1 thereunder [17 C.F.R. § 240.3a51-1], and the securities have traded at a price below $5 per share at all times since the stock began trading.

11. Lewis, age 44, resides in Huntsville, Alabama, and resided in Harrison, Maine, at all relevant times. He was the president, chief executive officer, and a director of Alliance at all relevant times and was responsible for business development and the day-to-day operations of the Company. Lewis caused Alliance to make false and misleading public disclosures in press releases and on its website.

12. Richard Dabney, age 40, resides in Rancho Palos Verdes, California, and resided in Torrance, California, at all relevant times. He was the managing director and treasurer of Alliance beginning in December 2004 and was responsible for Alliance’s financial matters. Richard Dabney caused Alliance to make false and misleading public disclosures and to engage in the unregistered distribution of its securities.

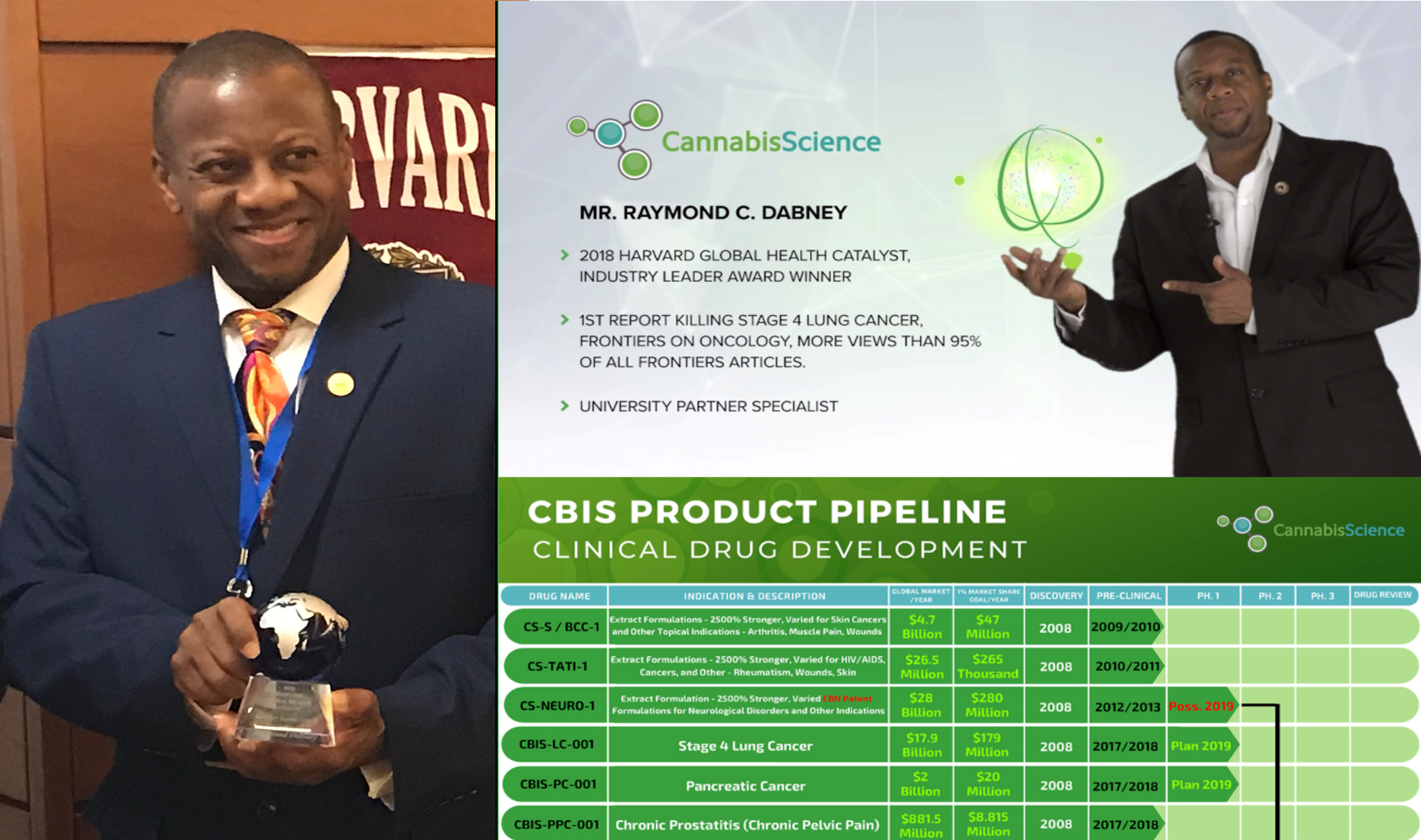

13. Raymond Dabney, age 43, resides in Vancouver, British Columbia, Canada. He is the brother of Richard Dabney and, from December 2004 to approximately November 2005, was a member of Alliance’s board of directors. Although Raymond Dabney ceased to be publicly identified as an officer or director of Alliance following a November 2005 disciplinary proceeding brought by the British Columbia Securities Commission that barred him from serving as an officer or director of any issuer, he continued to exercise great influence over the

Case 2:08-cv-01464-NVW Document 1

Filed 08/08/2008 P

Show more

American States University

June 1, 2025, Pre-Launch Success! Click the below Image link to setup your Account and begin your Crypto Journey with us. All Crypto Coin Buyers receive a Limited Time Pre-Launch offer! The Time is Now.

1-Million Strong Killing Cancers!

Click the Below Image to Review our Cancer Drug Comparables

*** Warning this document contains graphic images.

CSi-VIP Awards & NASDAQ Updates

Please Click the Below Image:

1st HARVARD Award Winning

Stage 4 Lung Cancer Killing Article:

*** Please click image below.

2nd HARVARD Award Winning

Stage 4 Lung Cancer Killing Article:

*** Please click image below.

*** PLUS

(3) other Cannabis Science

REAL WORLD Successes:

Stage 4 Breast Cancer

Skin Cancer

Karposis Sarcoma

The ASU Digital Business HUB will be used as the main business student learning center. GBXI will be the main pivot point to spin out trading shares of all our Partner Public and Private Companies such as Cannabis Science, iCannabinoid, Thermic Science, LNC, LMG, and a few more old and new school surprises for our loyal shareholders. No one will be missed! A true Digital Business HUB for students, just as planned all along.

Each spinout company will give our GBXI registered shareholders additional pro-rata shares in each spinout company over and above their original shares in each entity. This provides the required shareholder base for each company required to trade and gives additional shares to all our loyal GBXI shareholders.

We call this “Compounding our Wealth” through extra spinout share participation for all our loyal GBXI shareholders. Each registered GBXI shareholder will receive additional shares of each spinout Company over and above their original shares to enjoy additional liquidity as each company begins to trade through the GBXI Digital Business HUB spinout process.

Click here to review the Report:

Case No. 2:17-CV-02271-KJM-JDP

Inspire, Dream, Change

YOUR DIGITAL ERA Personal & Business Access Learning HUB

CSi-VIP & CBIS-Shareholder Legacy

Cannabis Science Financials & FINAL CBIS/CSi-VIP Share Numbers. Click the above Image link to view the latest Report.

November 5, 2025

Cannabis Science Shareholder FINAL Audit Confirmations

Click the above Image link to view the latest Report

September 23, 2025

Cannabis Science Shareholder Audit Confirmations Underway now!

Click the above Image link to view the latest Report.

July 7, 2025

Click the above Image link to view the latest cancer Killing promotional video. This is where you can join our 1-Million Strong youtube page to view more videos as we proceed forward.

June 1, 2025, Pre-Launch Success

Click the above Image link to setup your Account and begin your Crypto Journey with us. All Crypto Coin Buyers receive a Limited Time offer!

Click the ABOVE Image to Review our 1-Million Strong FC, Media Kit

*** Warning this document contains exciting images.

Pease Click the Calendar image to book your time to speak with Mr. Dabney about "Your Final CSi-VIP Shareholder Legacy".

Click the above Image to become one of the First 1-Million Strong Killing Cancers, Fight Club Members to help 'Make that Change' Join in Now! *** Warning this Membership contains Exciting Results.

PS ... ALL of our CSi-VIP's and those who Donated through the ASU/CSi-EDP GO-Fund-Me Promotion you do not need to purchase anything, you are ALREADY included in the "First" 1-Million Membership Club, CONGRATULATIONS !!!

Cannabis Science CEO, Presents …

The FINAL “CBIS GIFT Shares” Issuances!

DECEMBER 2024, Cheers! & HAPPY HOLIDAYS !!!

ALL GIFT Shares 1, 2, & 3 being ISSUED !!!

LAST Steps:

Please confirm Yours NOW !!!

1. CONFIRM Correct Total Share Amount(s)

2. CONFIRM Correct Name(s) on CERTIFICATE

3. CONFIRM Correct Mailing Address

ASU/CSi-EDP-ECO-System

At it's FINEST !!!

WHICH ONE ARE YOU ??

Those who, MAKE things happen.

Those who WATCH things happen.

Those who WONDER what the ... HAPPENED ???

We can make this HAPPEN way FASTER Working as a TEAM !!!

WHAT Matters is how much you CARE about KILLING CANCERS ...

This is it ... We are ALL Here ... Now ... with a Bunch of Celebrities going on TV Worldwide to Start raising $20 Million to Keep Killing Cancers.

2025 Audit considerations NASDAQ.

Cannabis Science Inc.

Share Structure 2025

Par Value: $0.001 USD

Last Price: $0.00647 USD

OTC Markets.

Common Stock:

Authorized:

5,000,000,000

Issued:

2,839,095,296

Fully Diluted:

4,510,547,648

Class A Common Stock

Authorized:

100,000,000

Issued:

0

Class B Common Stock

Authorized:

1,500,000,000

Issued:

0

Preferred Stock

Authorized:

1,000,000

Issued:

1,000,000

Sign up for a FREE Assessment to JOIN the UNIVERSITY Team or any ASU/CSi-EDP Team for whatever your AREA of Expertise is … then say no more… you already know.

You already know our Extensive LIST of GROUNDBREAKING Products.

1-Million STRONG TV Coverage, HARVARD Award Success.

TAKE YOUR PICK AND BECOME A PART OF HISTORICAL CHANGE

*** APPLY for FREE in CONFIDENCE and Success.

Each Product launch WE RELEASE will include Equity Participation according to standard salaries and share bonus structures.

EVERYONE sign up to add your STRENGTHS to OUR COMBINED SUCCESS and lets MAKE THIS HAPPEN NOW !!!

Activity Stream

Plaintiff United States Securities and Exchange Commission (“Commission”) alleges the following against Defendants Alliance Transcription Services,...Plaintiff United States Securities and Exchange Commission (“Commission”) alleges the following against Defendants Alliance Transcription Services, Inc. (“Alliance” or “Company”), Clifford A. Lewis (“Lewis”), Richard A. Dabney, Raymond C. Dabney, Philip M. Young (“Young”), Charles J. Smith (“Smith”), and William D. O’Neal (“O’Neal”):

SUMMARY

1. This matter concerns a scheme to manipulate the price and trading volume of Alliance stock through false and misleading public disclosures and to issue and sell Alliance stock in an unregistered distribution from at least April

vs.

Alliance Transcription Services, Inc.; Clifford A. Lewis; Richard A. Dabney; ) Raymond C. Dabney; ) Philip M. Young; Charles J. Smith; and ) William D. O’Neal, )

Case 2:08-cv-01464-NVW Document 1 Filed 08/08/2008 Page 1 of 17

1 2 3 4 5 6 7 8 9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2005 through at least September 2006. Alliance, a Nevada corporation, purported to provide unique expertise in the field of homeland security, and its common stock was quoted at all relevant times on the Pink OTC Markets quotation system formerly known as the Pink Sheets.

2. Defendants Alliance, Richard Dabney, and Lewis manipulated the market for Alliance’s stock by making false and misleading public disclosures in press releases issued by Alliance and published through business newswire services and on Alliance’s website.

3. Defendants Alliance, Richard Dabney, Raymond Dabney, Young, Smith, and O’Neal participated in the unregistered distribution of Alliance securities from July 2005 to September 2006 through a series of purported offerings by Alliance to a Texas company controlled by Smith. Raymond Dabney, Young, and Smith arranged for Alliance to issue stock to the Texas company in offerings that purportedly were exempt from registration and through which stock certificates purportedly could be issued without printed legends restricting the stock’s resale. In fact, the transactions between Alliance and Smith’s company were not exempt from registration and were merely a device to evade the registration provisions of the federal securities laws. Once issued to Smith’s company, the stock was immediately distributed to third parties without being paid for by Smith. Richard Dabney and O’Neal enabled Alliance to engage in those transactions by providing the necessary corporate resolutions and legal opinions, respectively.

4. Defendants Young, Smith, and O’Neal received Alliance stock through the unregistered distribution and sold it into the market without registration or a valid exemption from registration. Defendants Lewis, Richard Dabney, and Raymond Dabney received a portion of the proceeds that Young obtained by selling the Alliance stock.

5. By their conduct, Alliance, Lewis, and Richard Dabney violated

Case 2:08-cv-01464-NVW Document 1

Filed 08/08/2008 Page 2 of 17

2

1 2 3 4 5 6 7 8 9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 thereunder, and Alliance, Richard Dabney, Raymond Dabney, Young, Smith, and O’Neal violated Section 5 of the Securities Act of 1933 (“Securities Act”).

6. The Commission seeks relief including: permanent injunctions against all the Defendants; disgorgement of ill-gotten gains plus prejudgment interest thereon and civil monetary penalties against Lewis, Richard Dabney, Raymond Dabney, Young, Smith, and O’Neal; penny stock bars against Lewis, Richard Dabney, Raymond Dabney, Young, and Smith; officer-and-director bars against Lewis and Richard Dabney; and any other appropriate relief.

JURISDICTION

7. The Commission brings this action pursuant to Section 20(b) of the Securities Act [15 U.S.C. § 77t(b)] and Section 21(d) of the Exchange Act [15 U.S.C. § 78u(d)].

8. This Court has jurisdiction over this action pursuant to Sections 20(b) and 22(a) of the Securities Act [15 U.S.C. §§ 77t(b) and 77v(a)] and Sections 21(d), 21(e), and 27 of the Exchange Act [15 U.S.C. §§ 78u(d), 78u(e), and 78aa].

9. In connection with the acts, transactions, practices, and courses of business alleged in this Complaint, the defendants, directly or indirectly, made use of the means or instruments of transportation or communication in interstate commerce, the means or instrumentalities of interstate commerce, the mails, or the facilities of any national securities exchange.

THE DEFENDANTS

10. Alliance is a Nevada corporation that is based in Rancho Palos

Verdes, California, and was based in Harrison, Maine, at all relevant times. From December 2004 to August 2007, the Company, which was then known as Strategy X, Inc., purported to provide unique expertise in the field of homeland security.

Case 2:08-cv-01464-NVW Document 1

Filed 08/08/2008 Page 3 of 17

3

1 2 3 4 5 6 7 8 9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Alliance’s common stock was quoted on the Pink Sheets at all relevant times, but it has not traded actively since October 4, 2007, when the Commission ordered a 10-day trading suspension pursuant to Section 12(k) of the Exchange Act [15 U.S.C. § 78l(k)]. At all times relevant to this Complaint, Alliance’s common stock has been a penny stock because the Company’s net tangible assets and average revenues have been below the thresholds established under Section 3(a)(51) of the Exchange Act [15 U.S.C. § 78c(a)(51)] and Rule 3a51-1 thereunder [17 C.F.R. § 240.3a51-1], and the securities have traded at a price below $5 per share at all times since the stock began trading.

11. Lewis, age 44, resides in Huntsville, Alabama, and resided in Harrison, Maine, at all relevant times. He was the president, chief executive officer, and a director of Alliance at all relevant times and was responsible for business development and the day-to-day operations of the Company. Lewis caused Alliance to make false and misleading public disclosures in press releases and on its website.

12. Richard Dabney, age 40, resides in Rancho Palos Verdes, California, and resided in Torrance, California, at all relevant times. He was the managing director and treasurer of Alliance beginning in December 2004 and was responsible for Alliance’s financial matters. Richard Dabney caused Alliance to make false and misleading public disclosures and to engage in the unregistered distribution of its securities.

13. Raymond Dabney, age 43, resides in Vancouver, British Columbia, Canada. He is the brother of Richard Dabney and, from December 2004 to approximately November 2005, was a member of Alliance’s board of directors. Although Raymond Dabney ceased to be publicly identified as an officer or director of Alliance following a November 2005 disciplinary proceeding brought by the British Columbia Securities Commission that barred him from serving as an officer or director of any issuer, he continued to exercise great influence over the

Case 2:08-cv-01464-NVW Document 1

Filed 08/08/2008 P

Show more