Get Connected!

Come and join our community. Expand your network and get to know new people!

American States University

Recent GBXI News:

May 11, 2023, GBX International Group, Inc., (OTC: GBXI)

GBX International Group, Inc. (OTC:GBXI) Confirms 2023 Strong Revenue Growth Guidance Projections by Combining Each Acquired Operating Company Product Release, Expects Strong Growth Sector by Sector Through its Multiple Product Releases into North American and International Markets

April 21, 2023, GBX International Group, Inc., (OTC: GBXI)

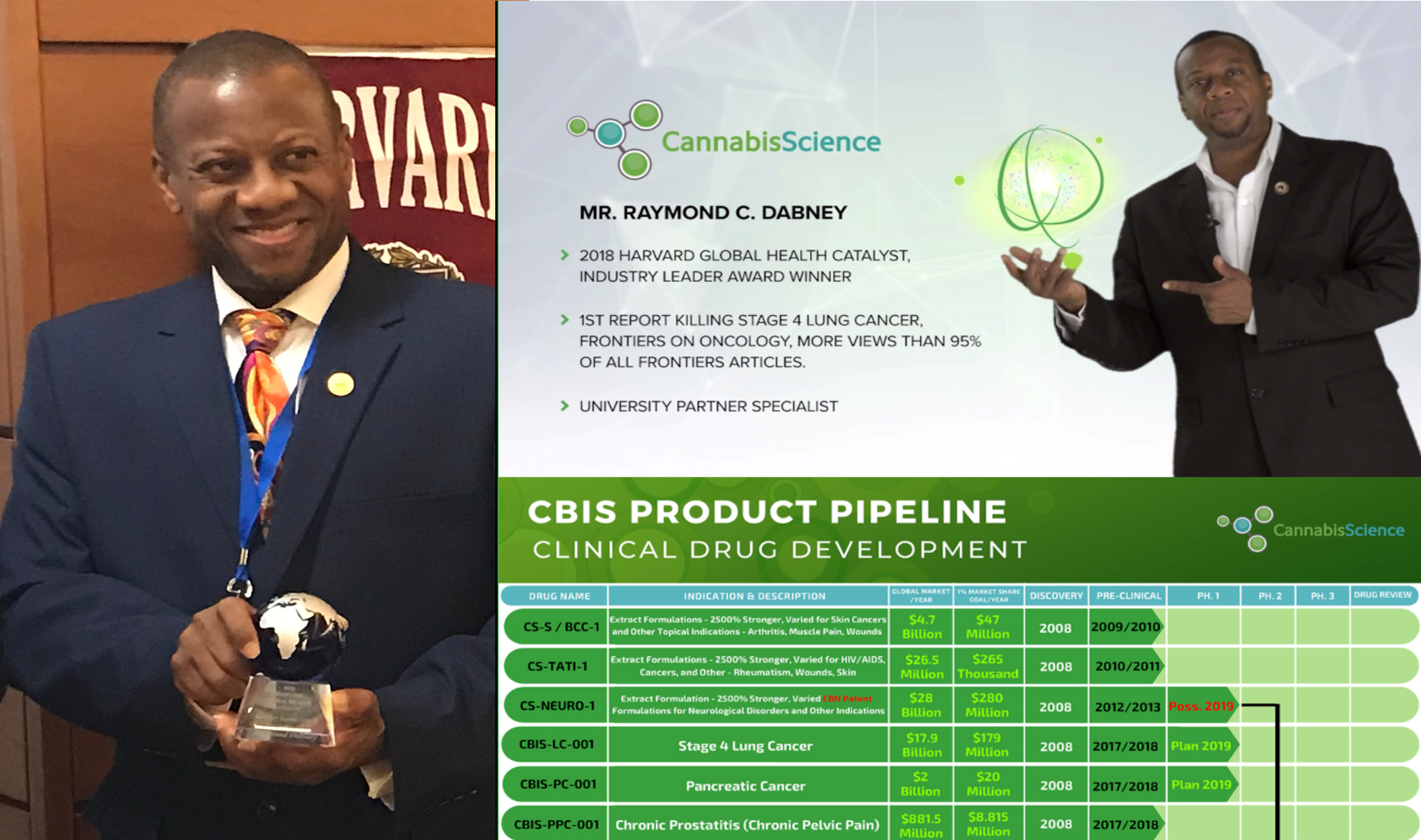

HARVARD Award Winning Entrepreneur, Mr. Raymond C. Dabney Acquires Majority Shareholder Control of GBX International Group, Inc. (OTC: GBXI) Makes More History Bringing CSi-EDP Partner American States University (ASU) as the First Acquisition for its Aggressive Growth Plans

The ASU Digital Business HUB will be used as the main business student learning center. GBXI will be the main pivot point to spin out trading shares of all our Partner Public and Private Companies such as Cannabis Science, iCannabinoid, Thermic Science, LNC, LMG, and a few more old and new school surprises for our loyal shareholders. No one will be missed! A true Digital Business HUB for students, just as planned all along.

Each spinout company will give our GBXI registered shareholders additional pro-rata shares in each spinout company over and above their original shares in each entity. This provides the required shareholder base for each company required to trade and gives additional shares to all our loyal GBXI shareholders.

We call this “Compounding our Wealth” through extra spinout share participation for all our loyal GBXI shareholders. Each registered GBXI shareholder will receive additional shares of each spinout Company over and above their original shares to enjoy additional liquidity as each company begins to trade through the GBXI Digital Business HUB spinout process.

Click here to review the Report:

Case No. 2:17-CV-02271-KJM-JDP

Inspire, Dream, Change

YOUR DIGITAL ERA Personal & Business Access Learning HUB

Groups

-

cancer survivors

- 4

- 2305

- 0

- 0

-

COVID-19 CoronaVirus

- 16

- 2777

- 2

- 0

-

Observational Studies

- 33

- 3039

- 3

- 0

-

Cannabis Science Pharmacies

- 39

- 6039

- 3

- 0

-

Investor Relations

- 614

- 16806

- 51

- 0

Notifications

Activity Stream

Sorry, this content isn't available

The link you followed may be broken, or the content may have been removed.

Go to the Frontpage Go to ProfileCannabis Science Inc. "Shareholder Loyalty Gift Center of Excellence"

HARVARD Award Winning

CANCER Killing Success

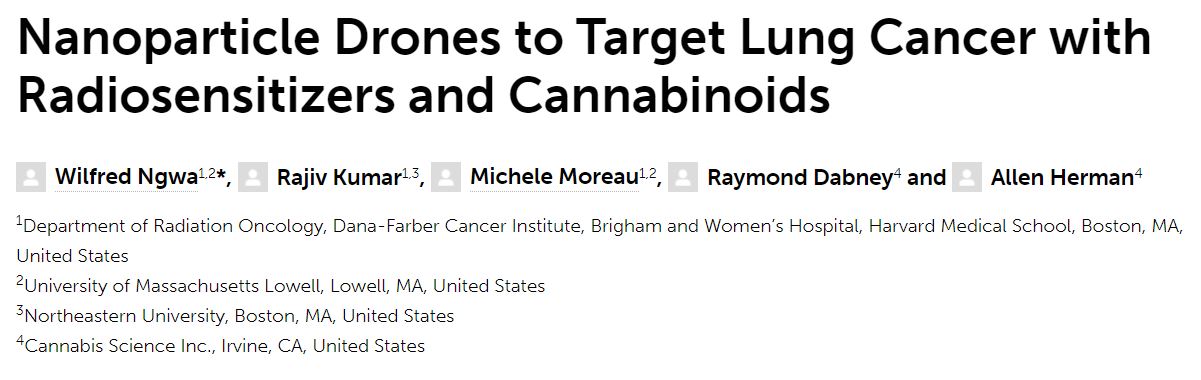

1st HARVARD Award Winning

Stage 4 Lung Cancer Killing Article:

*** Please click image below.

2nd HARVARD Award Winning

Stage 4 Lung Cancer Killing Article:

*** Please click image below.

*** PLUS

(3) other Cannabis Science

REAL WORLD Successes:

Stage 4 Breast Cancer

Skin Cancer

Karposis Sarcoma

Cannabis Science CEO, Presents …

The FINAL “CBIS GIFT Shares” Issuances!

DECEMBER 1, 2022, Cheers! & HAPPY HOLIDAYS !!!

ALL GIFT Shares 1, 2, & 3 being ISSUED !!!

LAST Steps:

Please confirm Yours NOW !!!

1. CONFIRM Correct Total Share Amount(s)

2. CONFIRM Correct Name(s) on CERTIFICATE

3. CONFIRM Correct Mailing Address

ASU/CSi-EDP-ECO-System

At it's FINEST !!!

WHICH ONE ARE YOU ??

Those who, MAKE things happen.

Those who WATCH things happen.

Those who WONDER what the ... HAPPENED ???

We can make this HAPPEN way FASTER Working as a TEAM !!!

WHAT Matters is how much you CARE about KILLING CANCERS ...

This is it ... We are ALL Here ... Now ... with a Bunch of Celebrities going on TV Worldwide to Start raising $20 Million to Keep Killing Cancers.

2023 Audit considerations NASDAQ.

Cannabis Science Inc.

Share Structure 2023

Par Value: $0.001 USD

Last Price: $0.00647 USD

OTC Markets.

Common Stock:

Authorized:

5,000,000,000

Issued:

2,521,095,296

Class A Common Stock

Authorized:

100,000,000

Issued:

0

Class B Common Stock

Authorized:

1,500,000,000

Issued:

0

Preferred Stock

Authorized:

1,000,000

Issued:

1,000,000

Sign up for a FREE Assessment to JOIN the UNIVERSITY Team or any ASU/CSi-EDP Team for whatever your AREA of Expertise is … then say no more… you already know.

You already know our Extensive LIST of GROUNDBREAKING Products.

1-Million STRONG TV Coverage, HARVARD Award Success.

TAKE YOUR PICK AND BECOME A PART OF HISTORICAL CHANGE

*** APPLY for FREE in CONFIDENCE and Success.

Each Product launch WE RELEASE will include Equity Participation according to standard salaries and share bonus structures.

EVERYONE sign up to add your STRENGTHS to OUR COMBINED SUCCESS and lets MAKE THIS HAPPEN NOW !!!